2025-07-24

Five ways to spend your 2024 personal income tax refund 2025

Whether you're planning ahead or paying down debt, we have five tips to help you turn your refund into financial momentum.

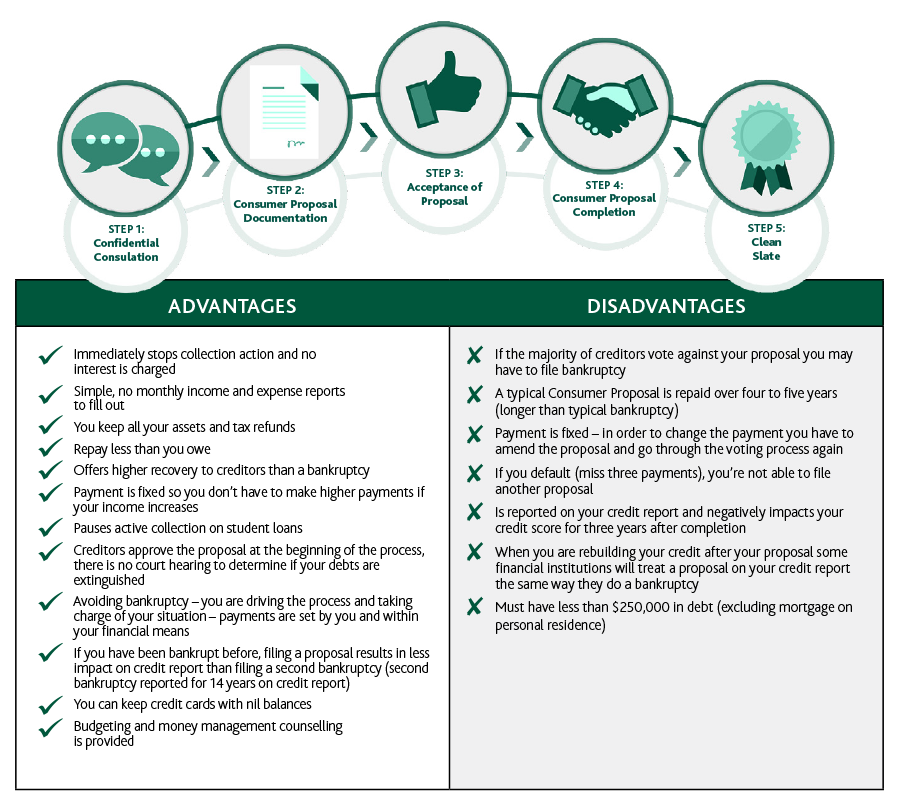

Consumer Proposals and bankruptcies are both government legislated options which can provide you with relief from significant debt problems. In addition, both debt solutions can only be administered by a Licensed Insolvency Trustee and provide a legal stay of proceedings which require creditors to discontinue harassing collection calls, garnishment or other legal proceedings.

Determining which, if either, option is an appropriate solution in your own unique situation depends on a number of variables. Let’s explore the advantages and disadvantages of both a Consumer Proposal and a bankruptcy.

2025-07-24

Whether you're planning ahead or paying down debt, we have five tips to help you turn your refund into financial momentum.

2025-07-23

Lifestyle Debt Alternatives to Bankruptcy

We’re here to answer your questions about whether you will be able to keep your vehicle if you choose Bankruptcy or a Consumer Proposal to work towards achieving a debt-free future.

2025-07-14

MNP Consumer Debt Index

Nearly half of Albertans (47%, +2 pts) report they are $200 or less away from financial insolvency each month — more than those in any other province — according to the latest MNP Consumer Debt Index.